Winter 2024 Quarterly Sector Trends Tracker of CEOs and C-Suite members at mainly mid-sized professional firms Completed by 97% of the 88 members of the Forum’s Tracker Research Panel between 23 Dec 2024 and 22 Jan 2025.

Commentary

1. The Winter 2024 Sector Trends Tracker was completed between 23 December 2024 and 22 January 2025 by an impressive 97% of the 88 members of the tracker research panel of CEOs and C-Suite members at mainly UK mid-sized professional services firms.

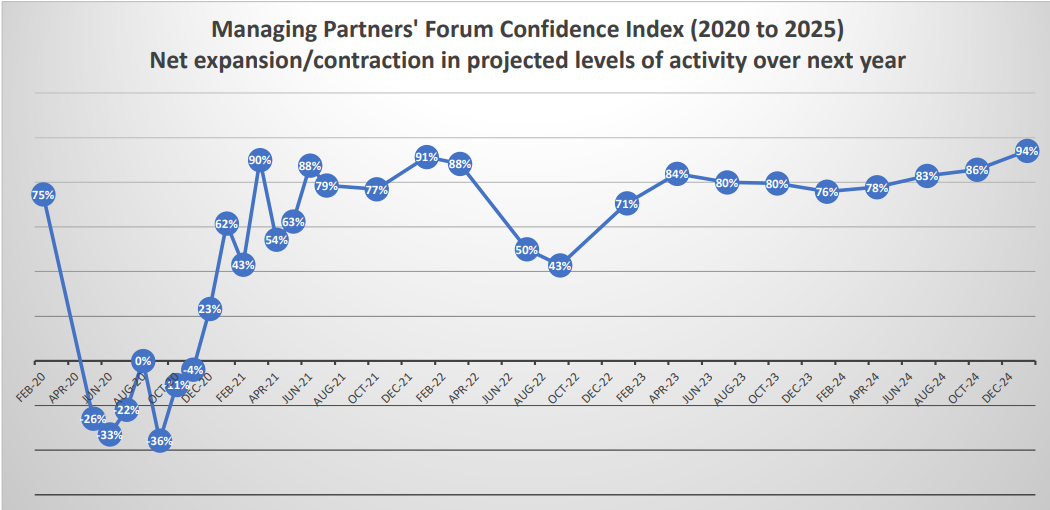

2. The Confidence index has continued to grow from 86% in the last tracker to 94%. The current index is made up of 94% of firms projecting expansion over the next 12 months and 0% contraction. Projected net expansion in new workflow has risen from 86% to 96%. Headcount projections have remained around 60%, the latter made up of 62% of firms projecting expansion and 3% contraction. This net expansion compares with over 70% for most of 2023.

3. ‘Finance & cash flow’ and ‘Marketing and new business generation’ carry most weight at partner/director discussions (58%), followed by ‘People and the firm as an employer’ at 50%. ‘Operational performance’ remains in fourth place, similar to 2023. By contrast, ‘Operational efficiency’ continues as the top priority for management (57%), followed by use of technology (up from 42% to 54%). As regards the constraints that are preventing firms from achieving optimal performance in the current economic climate, ‘Margin erosion’ and ‘Fee pressures’ remain at the top of the list (55%), followed by ‘Poor economic outlook’ (up from 41% to 50%). ‘Political uncertainty’ has reduced to 15%, with ‘Regulatory pressures’ remaining around 30%.

4. ‘Communicating effectively’ and ‘Getting the best from the team’ (both at 63%) remain the management activities that are seen as contributing most to helping a firm achieve its goals. As regards the dominant management style at their firm, 72% chose ‘Challenge & support’ with only 3% selecting ‘Command & control’.

5. As regards being on track for success, the scores for both firms and key clients have increased – 74% to 88% for firms; 66% to 76% for clients, but the gap has risen from 8% to 12%. 26% of firms believe that remote working has increased productivity, with 20% saying that it has decreased. By contrast, over 50% of firms said that it had increased productivity in the Autumn 2021 tracker.

6. Key client sectors include professional services (46% of firms source more than 10% of their revenues); financial services (40%); technology (23%) and local/central Government (17%).

7. 78% (up from 69%) of firms are looking for about the same amount of office space over the next 12 months. Yet, 59% of employees are now working between three quarters and full time at the office compared with 53% at the last Tracker.

The content of this summary can be used freely without limit, provided reference is made to the Managing Partners’ Forum Sector Trends Tracker ©2025 Practice Management International LLP